In the ever-evolving landscape of personal finance, it’s crucial to stay on top of your earnings and expenditures. Georgia, with its vibrant economy and diverse job opportunities, attracts individuals from all walks of life. Whether you’re a seasoned professional or just starting your career, understanding your income is essential for financial planning. This is where the Georgia Paycheck Calculator comes into play.

In this comprehensive guide, we will delve into the ins and outs of the Georgia Paycheck Calculator, why it’s an indispensable tool, and how to use it effectively. By the end of this article, you’ll have a clear understanding of how this tool can help you manage your finances, make informed decisions, and pave the way for a more secure financial future.

Understanding the Georgia Paycheck Calculator

What Is the Georgia Paycheck Calculator?

The Georgia Paycheck Calculator is an online tool that allows individuals to estimate their net pay, taking into account various factors such as income, deductions, and tax with holdings. It’s a valuable resource for both employees and employers, offering insights into an employee’s take-home pay and helping businesses calculate payroll accurately.

Why Is the Georgia Paycheck Calculator Important?

- Accurate Financial Planning: One of the primary reasons to use the Georgia Paycheck Calculator is to gain a clear understanding of your financial situation. By entering your income details, deductions, and other relevant information, you can calculate your net pay with precision. This knowledge empowers you to create a realistic budget, set savings goals, and make informed financial decisions.

- Tax Planning: Taxes are an inevitable part of your income, and understanding how much you’ll owe can help you avoid unpleasant surprises when tax season arrives. The Georgia Paycheck Calculator takes federal and state taxes into account, giving you an estimate of your tax liability. This enables you to plan for tax payments and explore potential tax-saving strategies.

- Salary Negotiation: If you’re negotiating a job offer or a raise, the Georgia Paycheck Calculator can be a valuable ally. By inputting different salary figures, you can assess the impact on your take-home pay. This data equips you with evidence-based arguments during negotiations, ensuring you’re compensated fairly for your work.

- Employee Benefits: Many employers offer a range of benefits, such as health insurance, retirement contributions, and flexible spending accounts. The calculator helps you understand how these benefits affect your overall compensation package. This knowledge is crucial when choosing between job offers or evaluating your current employment situation.

Using the Georgia Paycheck Calculator Effectively

How to Use the Georgia Paycheck Calculator

Now that we understand the importance of the Georgia Paycheck Calculator let’s walk through the steps to use it effectively:

Gather Your Information

Before you begin, collect all the necessary information. This includes your gross income, any pre-tax deductions (e.g., retirement contributions), post-tax deductions (e.g., health insurance premiums), and the number of allowances you want to claim on your W-4 form.

Access the Calculator

You can easily find online Georgia Paycheck Calculators provided by reputable financial websites and government agencies. These calculators are user-friendly and offer a secure environment to input your financial data.

Enter Your Gross Income

Start by entering your gross income. This is your total earnings before any deductions or taxes are taken out. If you receive a regular paycheck, this information can usually be found on your pay stub.

Include Deductions

Next, input any deductions you have. These can be both pre-tax and post-tax deductions. Common pre-tax deductions include retirement contributions and flexible spending account contributions. Post-tax deductions may include health insurance premiums and union dues.

Specify Allowances

On your W-4 form, you can specify the number of allowances you want to claim. A higher number of allowances means less money withheld for taxes, resulting in a higher take-home pay. However, claiming too many allowances may lead to owing taxes at the end of the year. Be sure to consult IRS guidelines or a tax professional when determining the right number of allowances for your situation.

Calculate Your Net Pay

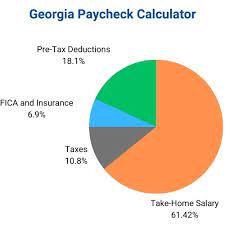

Once you’ve entered all the necessary information, click the “calculate” button. The calculator will generate an estimate of your net pay after taxes and deductions. You’ll also see a breakdown of your tax with holdings and deductions, providing valuable insights into your financial situation.

Analyze the Results

Review the results carefully Georgia Paycheck Calculator. Take note of your estimated net pay, tax with holdings, and deductions. This information will serve as a foundation for your financial planning and decision-making.

Adjust as Needed

If you’re not satisfied with the results, or if you’re considering changes to your financial situation (such as a salary increase or different deductions), use the calculator to experiment with different scenarios. This allows you to see how changes in your income or deductions will affect your net pay.

Conclusion

The Georgia Paycheck Calculator is a powerful tool that empowers individuals to take control of their financial futures. By providing accurate estimates of net pay, tax with holdings, and deductions, it facilitates informed decision-making, better budgeting, and smarter financial planning. Whether you’re a Georgia resident, a new hire, or a seasoned professional, this tool is an indispensable resource for managing your finances effectively.

As you navigate the complex landscape of personal finance, remember that the Georgia Paycheck Calculator is just one piece of the puzzle. Combine its insights with sound financial principles, such as budgeting, saving, and investing, to build a secure financial foundation. Additionally, consult with financial advisors or tax professionals to ensure your financial decisions align with your long-term goals.

By leveraging the Georgia Paycheck Calculator and adopting a proactive approach to your finances, you can pave the way for a brighter and more financially secure future in the Peach State. Stay informed, stay proactive, and watch your financial goals become a reality.