The Department of Veterans Affairs (VA) offers eligible veterans and active-duty service members a unique opportunity to achieve homeownership through VA loans. However, to qualify for this beneficial loan program, applicants must meet specific eligibility requirements outlined in the VA Loan Eligibility Matrix. In this article, we will explore the VA Loan Eligibility Matrix in detail, including the main eligibility criteria, entitlement calculations, and additional factors that influence eligibility.

I. Basic Eligibility Criteria:

To be eligible for a VA loan, individuals must meet certain fundamental requirements. Understanding these criteria is the first step toward determining eligibility.

- Service Requirements: Applicants must have served a minimum period of active duty, usually 90 consecutive days during wartime or 181 continuous days during peacetime. National Guard and Reserve members may also qualify with at least six years of service. For those discharged before meeting the minimum service requirements, specific circumstances, such as service-related disabilities, may still grant eligibility.

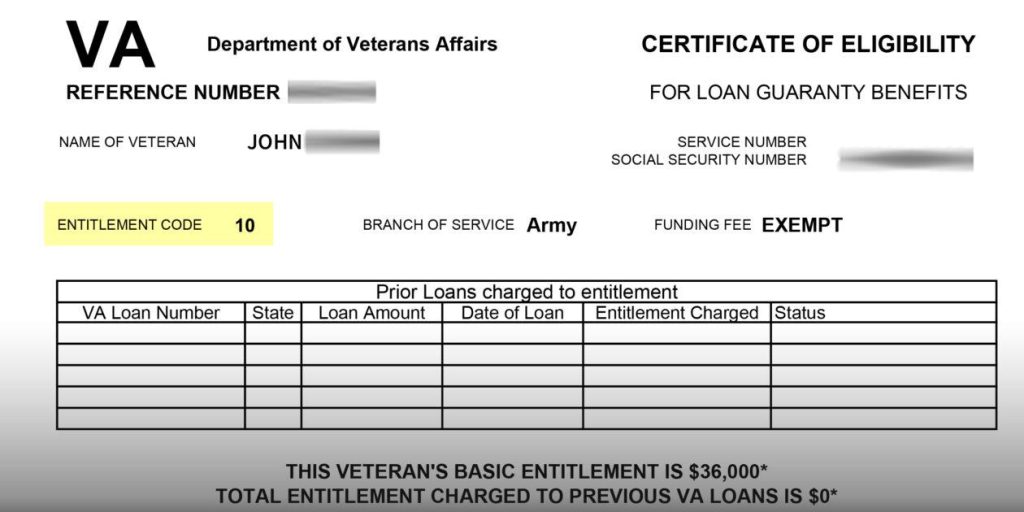

- Certificate of Eligibility (COE): Obtaining a COE is essential for VA loan eligibility. The COE verifies an individual’s service history and determines their level of entitlement. It can be acquired through the VA or directly from an approved lender by providing necessary documentation, such as discharge papers (DD-214), statement of service, or NGB Form 22 (for National Guard and Reserve members).

- Credit and Income Requirements: While VA loans generally have more flexible credit standards compared to conventional loans, lenders will still evaluate an applicant’s creditworthiness. A satisfactory credit history and a stable income that demonstrates an ability to repay the loan are important factors in the approval process.

II. Entitlement and Entitlement Calculations:

Understanding entitlement is crucial for determining the loan amount for which an individual is eligible. The VA establishes a maximum guaranty amount, which affects the loan limit and down payment requirements.

- Basic Entitlement: The basic entitlement is the VA’s guarantee to repay a certain portion of the loan in case of default. It is usually 25% of the loan amount, up to the maximum guaranty limit. The current maximum guaranty amount is $144,000, but this can vary depending on the county where the property is located.

- Remaining Entitlement: The remaining entitlement is the portion of the basic entitlement that has not been used. It determines the maximum loan amount without requiring a down payment. Lenders generally require borrowers to have sufficient remaining entitlement to cover at least 25% of the loan amount.

- Entitlement Calculations: Calculating entitlement can be complex, especially for borrowers who have previously used their entitlement. Factors such as the amount of entitlement previously used and the loan limit in the county where the property is located affect the calculation. The VA Loan Eligibility Matrix provides detailed guidelines to determine the specific entitlement amount for each individual.

III. Additional Factors Influencing Eligibility:

Apart from the basic eligibility criteria and entitlement calculations, there are other important factors to consider when assessing VA loan eligibility.

- Property Eligibility: VA loans are intended for primary residences and can be used for various types of properties, including single-family homes, condominiums, and multi-unit properties (up to four units). However, the property must meet the VA’s Minimum Property Requirements (MPRs) to ensure it is safe, habitable, and structurally sound.

- Funding Fee: The VA loan program requires borrowers to pay a funding fee, which helps offset the cost of the program to taxpayers. The funding fee percentage varies based on factors such as the borrower’s service category, down payment amount, and whether they have previously used their VA loan benefits. The fee can be financed into the loan amount or paid upfront.

- Loan Limits: The VA establishes loan limits, which determine the maximum loan amount that can be guaranteed by the VA. These limits vary depending on the county and are designed to reflect the cost of housing in different areas. Borrowers can still obtain loans above these limits, but they may be required to make a down payment on the portion that exceeds the limit.

Conclusion:

The VA Loan Eligibility Matrix serves as a comprehensive guide for veterans and active-duty service members to determine their eligibility for VA loans. By understanding the basic eligibility criteria, entitlement calculations, and additional factors that influence eligibility, individuals can navigate the loan application process more confidently. It is important to consult with VA-approved lenders or mortgage professionals to obtain accurate and up-to-date information regarding VA loan eligibility and maximize the benefits of this valuable homeownership opportunity.