When seeking a mortgage, many borrowers choose to work with a mortgage broker to navigate the complex process. As part of the arrangement, a Mortgage Broker Fee Agreement is established to outline the fees, services, and obligations of both the borrower and the mortgage broker. In this article, we will delve into the details of a Mortgage Broker Agreement, including its importance, key components, and considerations for borrowers.

I. Importance of a Mortgage Broker Fee Agreement:

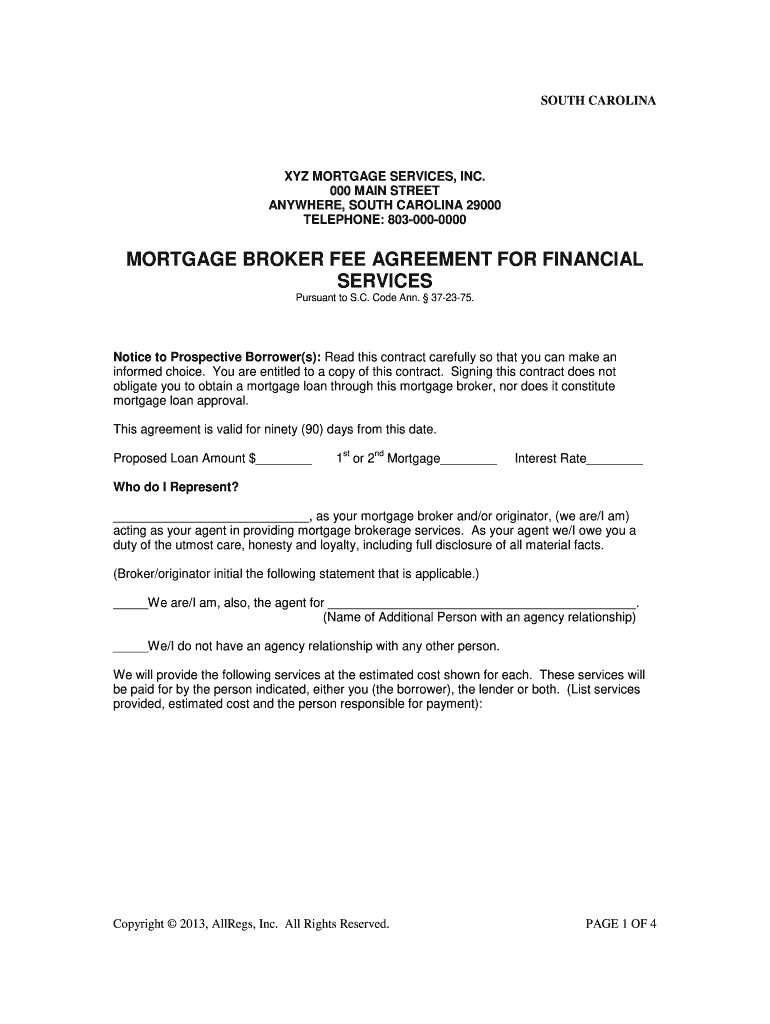

A Mortgage Broker Fee Agreement is a crucial document that establishes a clear understanding between the borrower and the mortgage broker regarding the services provided and the associated fees. It ensures transparency, sets expectations, and helps prevent misunderstandings or disputes throughout the mortgage process.

- Clarity in Services: The agreement outlines the specific services the mortgage broker will provide, such as mortgage product research, application submission, lender negotiations, and ongoing support. Having a clear understanding of the services offered allows borrowers to make informed decisions and assess the value provided by the mortgage broker.

- Fee Disclosure: A Mortgage Broker Agreement provides transparency regarding the fees and costs associated with the mortgage broker’s services. This includes not only the broker’s fees but also any potential third-party fees, such as credit report fees or appraisal fees. Understanding the full cost structure helps borrowers budget appropriately and compare different mortgage broker options.

- Legal Protection: By formalizing the agreement in writing, both the borrower and the mortgage broker are protected legally. In case of any disputes or misunderstandings, the agreement serves as a reference point for resolving issues and clarifying obligations.

II. Key Components of a Mortgage Broker Fee Agreement:

A well-drafted Mortgage Broker Fee Agreement includes several essential components that provide clarity and protection for both parties involved.

- Scope of Services: The agreement should clearly outline the specific services the mortgage broker will provide. This may include pre-qualification assistance, loan product recommendations, application submission, coordinating with lenders, and providing ongoing support throughout the mortgage process. Detailing the scope of services ensures that both parties have a shared understanding of the broker’s responsibilities.

- Fee Structure and Payment Terms: The agreement should specify the fee structure and payment terms agreed upon by the borrower and the mortgage broker. This includes the broker’s compensation, which is typically a percentage of the loan amount or a flat fee. Additionally, it should outline when and how the fees are to be paid, whether it is upfront, at closing, or through financing.

- Disclosure of Third-Party Fees: In addition to the broker’s fees, the agreement should disclose any third-party fees that the borrower may incur, such as appraisal fees, credit report fees, or title search fees. Clear disclosure of these fees ensures transparency and helps borrowers understand the full cost of obtaining a mortgage.

III. Considerations for Borrowers:

When entering into a Mortgage Broker Fee Agreement, borrowers should keep certain considerations in mind to protect their interests and make informed decisions.

- Shop Around: Borrowers should not hesitate to shop around and compare multiple mortgage brokers to find the most suitable one for their needs. Reviewing different fee structures, services offered, and the reputation of the brokers can help borrowers make an educated choice.

- Understand the Fee Structure: It is essential for borrowers to fully comprehend the fee structure outlined in the agreement. This includes not only the percentage or flat fee charged by the broker but also the breakdown of other potential costs. Asking questions and seeking clarification before signing the agreement can prevent any surprises later on.

- Negotiate: Borrowers can negotiate certain terms of the Mortgage Broker Fee Agreement, such as the broker’s fee or payment terms. While negotiation may not always be possible, it is worth exploring to ensure a fair arrangement.

Conclusion:

A Mortgage Broker Fee Agreement plays a vital role in establishing a clear understanding between borrowers and mortgage brokers. By clearly defining the services provided, disclosing fees, and protecting the interests of both parties, this agreement promotes transparency, clarity, and legal protection throughout the mortgage process. Borrowers should carefully review and understand the agreement’s components and consider their options to ensure they work with a reputable mortgage broker who offers a fair fee structure and provides the desired services.